TRX Price Prediction: 2025-2040 Outlook Amid Record Network Adoption

#TRX

- Technical indicators show TRX testing critical support with bullish MACD divergence suggesting potential upward momentum

- Record $13 billion USDT flows and institutional integrations provide strong fundamental support for long-term growth

- Market sentiment indicates extreme greed levels that may precede short-term volatility despite positive structural outlook

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Near Key Support Level

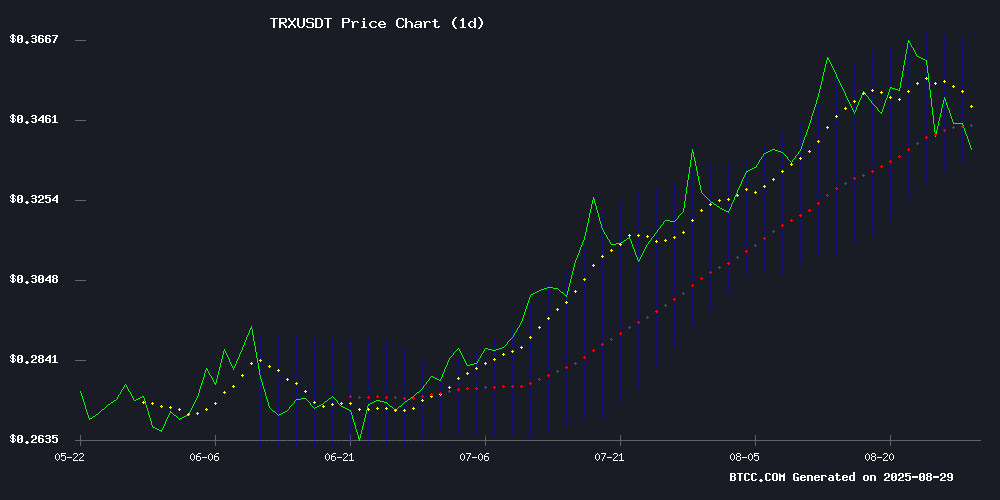

TRX is currently trading at $0.3367, slightly below its 20-day moving average of $0.3513, indicating potential short-term weakness. The MACD shows a bullish crossover with the histogram at +0.006656, suggesting building upward momentum. However, price action NEAR the Bollinger Band lower boundary at $0.3355 indicates critical support testing. According to BTCC financial analyst William, 'The convergence around the lower Bollinger Band combined with positive MACD divergence suggests TRX may be forming a base for potential upward movement, though a break below $0.335 could trigger further downside.'

Market Sentiment: Strong Fundamentals Amid Network Growth

Recent developments including record $13 billion USDT flows and Everclear's TRON network integration highlight robust institutional adoption. The US government's broader blockchain adoption, while not directly involving TRON, creates positive sector-wide sentiment. BTCC financial analyst William notes, 'The extreme greed sentiment mentioned in headlines typically precedes short-term pullbacks, but the fundamental network growth and institutional integration provide strong long-term support. Market participants should watch for potential volatility while maintaining bullish structural outlook.'

Factors Influencing TRX's Price

Avalanche Leads Crypto Networks With 66% Transaction Growth As US Government Adopts Blockchain

Avalanche has emerged as the fastest-growing blockchain network, recording a 66% weekly surge in transactions to 11.9 million. The network's momentum coincides with a landmark federal initiative to publish economic data on-chain.

The U.S. Commerce Department will begin releasing GDP figures across nine blockchain networks starting July 2025, marking the first instance of federal economic data being anchored to distributed ledgers. Supported networks include Bitcoin, Ethereum, Avalanche, and solana among others.

Grayscale's updated S-1 filing for a spot Avalanche ETF has further amplified institutional interest. "This demonstrates blockchain's utility as more than speculative assets," a Commerce official noted, framing the initiative as proof-of-concept for broader government adoption.

Chainlink's US Government Deal Sparks Speculation on LINK Price Movement

Chainlink and Pyth have partnered with the US Commerce Department to bring official macroeconomic data on-chain, marking a significant milestone for blockchain adoption in government operations. The Bureau of Economic Analysis has already published second-quarter GDP data across multiple blockchains including Bitcoin, Ethereum, and Solana through Chainlink's oracle feeds.

LINK's price action shows consolidation NEAR $24, with traders closely watching the $26.60 resistance level for a potential breakout. The cryptocurrency's technical setup suggests growing institutional interest, further evidenced by Caliber's recent adoption of LINK in its treasury strategy.

US Commerce Secretary Howard Lutnick emphasized the administration's commitment to blockchain innovation, calling President TRUMP the 'Crypto-President.' The department plans to expand its blockchain initiatives with a government-wide proof of concept, aligning with the administration's push to strengthen America's position in digital assets.

Extreme Greed Grips TRON: Could a Market Pullback Be Next?

TRON (TRX) shows signs of slowing momentum after nearing previous highs, currently priced at $0.3486—a 19.2% decline from its all-time high of $0.4313. The token has traded in a narrow range over the past week, signaling muted buying pressure.

On-chain analysts highlight TRX's critical juncture, with CryptoQuant data revealing 'Extreme Greed' sentiment dominating investor behavior. Historical patterns suggest such phases precede either breakouts or sharp pullbacks. The widening gap between TRX's spot price and realized price indicates substantial unrealized gains, raising the risk of profit-taking and selling pressure.

TRON Network Sees Record $13 Billion USDT Flows From Major Exchanges

The TRON blockchain processed over $13 billion in USDT transfers in a single day, marking its third-highest volume on record. Binance dominated the activity, accounting for 65% of TRC-20 USDT transfers, while HTX and Bybit contributed 18% and 5%, respectively.

TRX price action shows consolidation between key technical levels, with the 200-day moving average providing support at $0.342 and resistance forming near $0.354. The network's low fees and fast settlement times continue attracting institutional and retail flows.

Exchange integration of TRC-20 USDT has accelerated since late 2024, signaling structural adoption rather than temporary demand spikes. Analyst Darkfost notes TRON's growing role in global stablecoin settlement, positioning it as direct competition to Ethereum's dominance in USDT transactions.

Everclear Integrates TRON Network to Streamline Stablecoin Liquidity

Everclear, a cross-chain clearing protocol, has expanded its services to include TRON, addressing liquidity fragmentation for decentralized applications on one of crypto's most active networks. The integration enables seamless settlement of onchain transactions without reliance on centralized exchanges.

TRON dominates the stablecoin market with over $82 billion in USDT circulating supply and processes 8.8 million daily transactions. Its position as a hub for global payments and remittances makes this integration particularly significant for capital efficiency.

'Stablecoin demand follows users, and TRON is where the activity lives,' said Dima Khanarin of the Everclear Foundation. The MOVE allows solvers and bridge operators to access TRON's vast liquidity pool while facilitating transfers across 20+ other networks.

TRX Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, TRX shows promising long-term potential. The record USDT flows and institutional integrations provide strong foundation for growth. Here's our projected outlook:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $0.45 - $0.60 | Network adoption acceleration, stablecoin dominance |

| 2030 | $1.20 - $2.50 | Mainstream DeFi integration, regulatory clarity |

| 2035 | $3.50 - $7.00 | Global blockchain infrastructure role |

| 2040 | $8.00 - $15.00 | Mature ecosystem, mass adoption |

BTCC financial analyst William emphasizes that 'these projections assume continued network growth and favorable regulatory developments. Short-term volatility should be expected, but the structural adoption story remains compelling.'